[As of this writing, the Dow Jones Industrial Average is down over 930 points.]

I’ve said this before, but under the circumstances, I think it’s worth repeating. Donald and I have basically one thing in common: we’re absolutely terrible with money. The difference in that one point of commonality, however, is that I have no problem admitting it. I do not have to endanger the global economy in order to prove that I’m good at something at which I am objectively terrible.

It makes sense, of course, that Donald and I would both be very bad with money considering the awful and tragically important position it had in our awful and tragic family, but even within that context, he and I came by our dysfunction very differently.

Donald is bad with money (his own and other people’s) because his father threw so much of it at him over the course of his entire childhood and adulthood—without condition—that he never had to learn how to deal with it properly. (It probably goes without saying that I had the opposite problem with my grandfather.)

Having been chosen as my grandfather’s eventual heir, however, Donald did learn a thing or two about corruption, grey-hat business tactics, and cheating.

Now, my own financial shortcomings aside, I think I have enough of a grasp of basic economic principles to recognize market manipulation when I see it. From where I’m standing, Donald Trump just manipulated the markets–and he did so by caving, by giving in, by being the abject loser he has always tried to pretend he is not. He can spin it all he wants—and he will in ways that will further push the bounds of credulity—but even if the outcome has been lucrative for Donald and his insiders, what happened yesterday capped a two-month streak of the most disastrous, ignorant, and quite frankly idiotic game of brinksmanship in American history. The man is a menace because he is at the end of the day so profoundly stupid, weak, and degraded. He knows it, too, in the terrifying depths of his unconscious, because, in order to save face and trick people into thinking he’s a tough guy, he worsened an already very bad situation by allowing the 125% tariff against Chinese goods to stand. This is yet more ostensibly inexplicable economic suicide.

Are we supposed to believe that Donald Trump changed his mind? That he suddenly realized he was taking this country down a self-destructive path? Are we truly supposed to believe that Donald of all people came to his senses and reached the conclusion that he was wrong? This even though just yesterday White House press secretary Karoline Leavitt said that the reporting on the 90-day pause was “fake news?”

In order to determine whether or not this 90-day pause is potentially market manipulation or some form of insider trading, we need to go back a bit in the timeline. By doing so, we’ll begin to get a sense of the gravity of the situation we’re dealing with. Whether by his own design or, much more likely, because people closest to him recognized an opportunity to exploit the catastrophic global economic panic Donald had single-handedly created with his breathtakingly moronic tariff war.

Just after midnight, Donald slapped China with an absolutely extraordinary 104% tariff. Around seven o’clock this morning, China raised its retaliatory tariffs against us to 84%, as they should. Global markets plummeted.

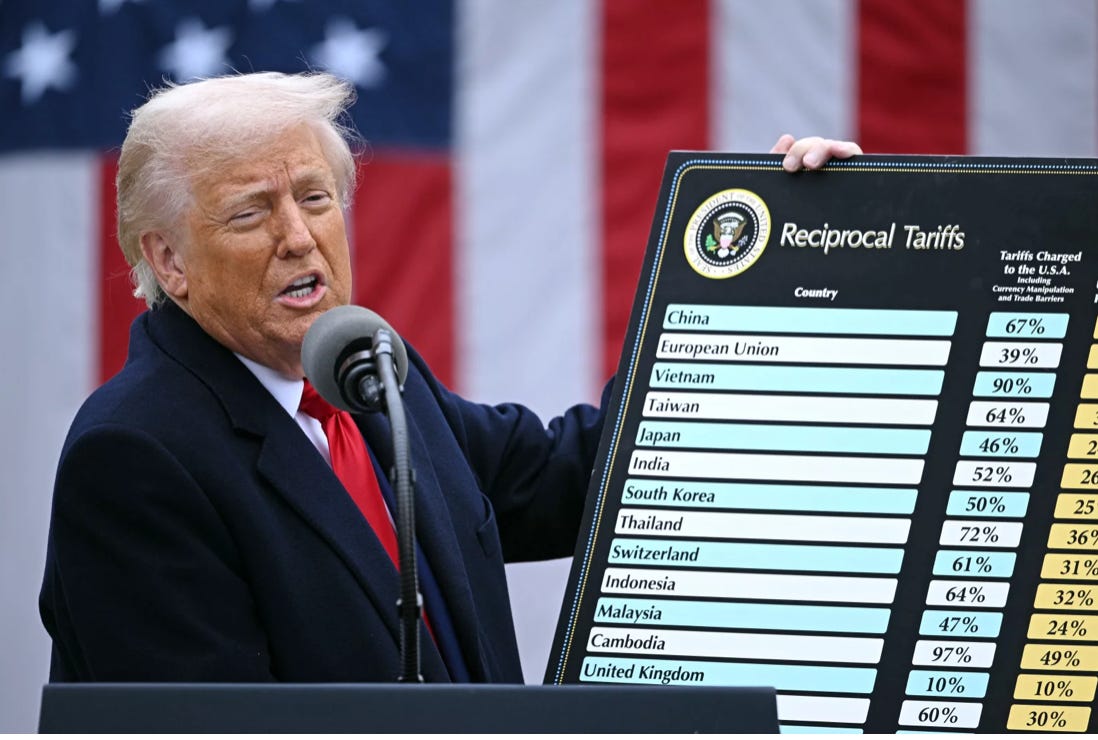

At 9:33 a.m., Donald posted this on his failing social media sight:

Be cool, everything is going to work out well. The USA will be bigger and better than ever before.

This was followed minutes later by another post:

THIS IS A GREAT TIME TO BUY! DJT

I wonder what he’s advising people to buy here. Stocks, perhaps, because, thanks to him, they’ve become so cheap over the last few days. That’s what happens when you crash the market.

It’s funny though. Just the night before all of this went down, Donald addressed his sweeping tariffs during a speech at the National Republican Congressional Committee president’s dinner:

This time, I’m doing what I want to do with respect to the tariffs. I think we’re going to do much better. Don’t let some of these politicians go around saying, you know, 'cause I’m telling you, these countries are calling us up kissing my ass. They are dying to make it here. “Please, please don’t make it. I’ll do anything. I’ll do anything, sir.” And then I’ll see some Republican, you know, some guy that wants to grandstand, say, “I think that Congress should take over negotiations.” Let me tell you, you don’t negotiate like I negotiate.

I would argue against the notion that nobody “negotiates” like Donald does. Mob bosses and terrorists do. Also, absolutely nobody is calling him up and saying, “Sir, please make a deal with us,” because all of our trading partners know that he’s engaging in the most blatant form of blackmail and he’s doing it from a position of weakness. You cannot blackmail somebody successfully unless you have the upper hand–but Donad seems to be the only person who doesn’t know this.

Donald woke up yesterday morning to the reality of his failures as markets were significantly down—again—globally. Under such circumstances, in the midst of the chaos and uncertainty he created, who is going to strike a deal with the United States of America? Recognizing the new reality, the European Union voted to approve a first round of tariffs against the United States in retaliation for getting slapped with tariffs on American steel and aluminum. That is the opposite of what Donald suggested was happening.

Shortly after 1:00 p.m. yesterday, just four hours after he told everybody it was a great time to buy cheap stocks, he folded to mounting pressure, walked back his tariffs and instead imposed, a substantially lower tariff across the board—10% for 90 days.

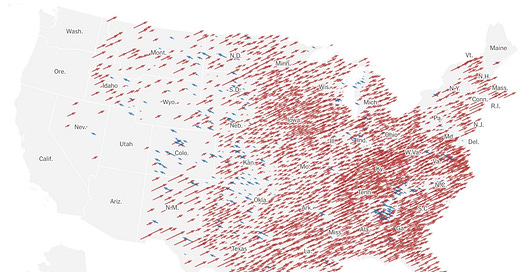

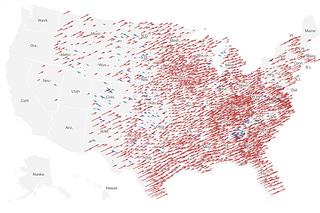

Is this what he meant when he said everything is going to work out? Perhaps, because shortly after the announcement, the market skyrocketed as if somebody had lit a fuse under it.

Have we ever seen a president or anyone, for that matter, manipulate global stocks in this way and in such a ludicrously short period of time?

I don’t know about you, but I am sick to death of governance by tweet. There are channels that need to be gone through. There are processes that need to be followed. You are not just supposed to write something on social media and then have your underlings retcon everything so your reckless pronouncements become official policy.

As became clear under questioning in hearings yesterday in front of the House Ways and Means Committee under Nevada Representative Steven Horsford, Donald’s trade representative, Jameson Greer, had absolutely no idea what was going on in the regime he serves despite the fact that it’s his job to know.

Horsford then asked Greer an obvious but important question.

HORSFORD: Is this market manipulation?

GREER: No.

HORSFORD: Why not? If it was a plan, if it was always the plan, how is this not market manipulation?

GREER: It’s not market manipulation, sir.

HORSFORD: Well, then what is it? Because it sure is not a strategy. We’re trying to reset the global trade system. And what has that done? How have you done? How have you achieved any of that, but to enact enormous harm on the American people?

Brilliantly done and a point worth highlighting: Just because the stock market erased a significant percentage of its losses yesterday, everything is not ok. People have been suffering. Our trade alliances have frayed perhaps the point of repair. Global trade has been rocked in ways that will reverberate for a very long time. Essential products are more expensive. Inflation is on the rise. America’s reputation has been set on fire. Due to the almost unthinkable amount of chaos and uncertainty Donald has injected into the system, people panicked into making financial decisions that will likely harm, at least in the short-term. The harm has been done.

Something is very, very wrong here. The president of the United States is almost certainly breaking the law to enrich himself and those in his inner circle, and he’s doing it illegally. While he and a handful of already obscenely wealthy people benefit, he’s playing Russian roulette with the financial stability of the American people.

Donald, of course, was ready with a self-serving explanation.

You know, I think in financial markets, because they changed. Look how much it changed today. We went from, you know, pretty moderate today, but over the last few days, it looked pretty glum. To, I guess they say it was the biggest day in financial history. That’s a pretty big change. And I think the word would be flexible. You have to be flexible. Like, he’s asking the question about some companies. Some companies, through no fault of their— they happen to be in an industry that is more affected by these things than others. You have to be able to show a little flexibility. And I’m able to do that.

Donald Trump has never been flexible in his entire life. Like his father before him, he is utterly inflexible and he has constructed his life in order never to have to bend to anybody else’s will. He never changes course because changing course means having to admit he’s wrong, which he is constitutionally incapable of doing.

The only explanation here is there was some ulterior motive, which I do not believe originated with Donald who knows nothing about trade negotiations, trade imbalances, the global economy, or macroeconomics. He doubled and quadrupled down on his tariffs because he only understands dominance and his need for dominance is a way for him to compensate for his being such a weak, pathetic loser.

He unintentionally created an opportunity that somebody else recognized, just as they recognized how easily manipulable and useful Donald can be. Odds are that that person simply whispered in his ear, “Hey, Donald, if you’re willing to break the law and engage in a little market manipulation, you can get even richer.”

I don’t think Donald crashed the market on purpose, but given his history of corruption and market manipulation, it shouldn’t surprise us that he was willing to go along with this scheme.

This is the kind of thing Donald and my grandfather did back in the '80s.

Here’s an excerpt from the extraordinary 2018 New York Times investigative piece on Donald by Russ Buettner and Susanne Craig explaining how this all worked:

During the 1980s, Donald Trump became notorious for leaking word that he was taking positions in stocks, hinting of a possible takeover, and then either selling on the run-up or trying to extract lucrative concessions from the target company to make him go away. It was a form of stock manipulation with an unsavory label: greenmailing.

The Times unearthed evidence that Donald enlisted his father Fred as his greenmailing wingman. On January 26, 1989, Fred bought 8,600 shares of Time Inc. for $934,854. His tax returns show that seven days later, Dan Dorfman, a financial columnist known to be chatty with Donald Trump, broke the news that the younger Trump had taken a sizable stake in Time, and sure enough, Time shares jumped, allowing Fred to make a $41,614 profit in two weeks.

That was a lot of money in 1989. Donald is an idiot, but he was taught at my grandfather's knee and corruption is second nature to him. He may be completely bereft of common sense let alone expertise when it comes to finances, but he is a crook. He is corrupt to the core, and when presented with opportunities like this he will always do the worst thing because he is Donald Trump.

It's sad that he can get away with all this. It sometimes seems hopeless. Congress and Senate Republican own this. They can put a stop to this at any time. The corruption is so obvious. One can only hope that if and when we get through this that there are laws passed to prevent all of this from happening again and that all these starting with Donald stand trial for what they have and are continuing to do to us.

I shared this on my BlueSky account. This article is so on the money and I love how Mary Trump just basically tells it like it is! She has more gumption (known more by another word!) than all of the GOP!